Get the free alcohol dealer registration form 5630 5d

Show details

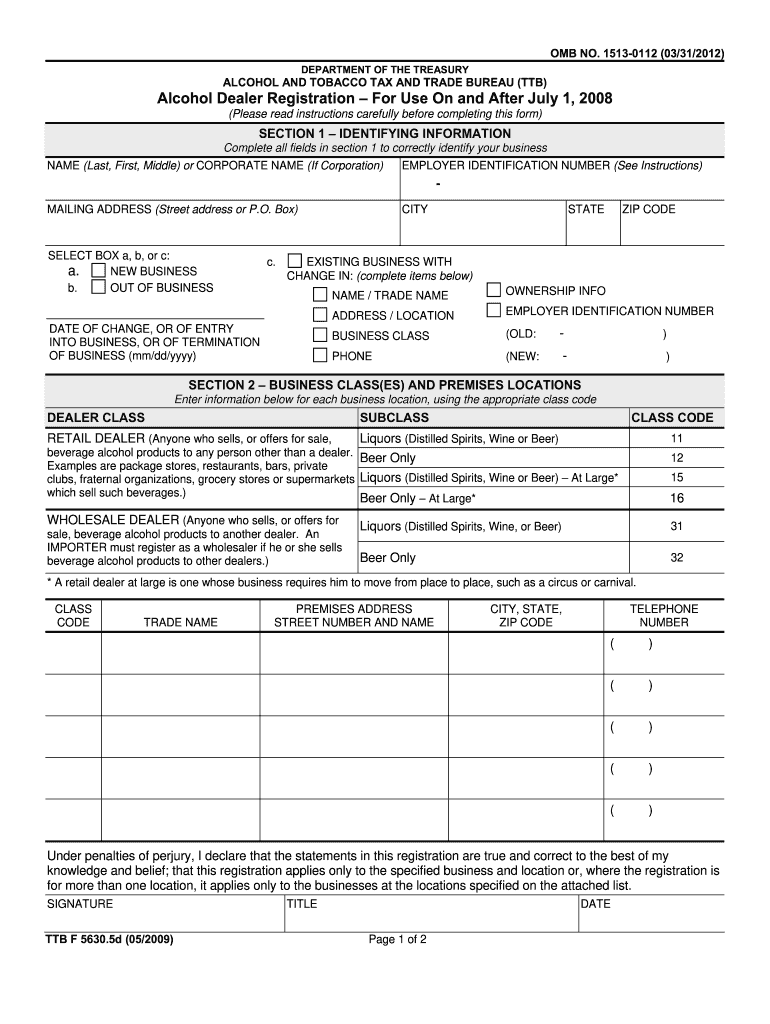

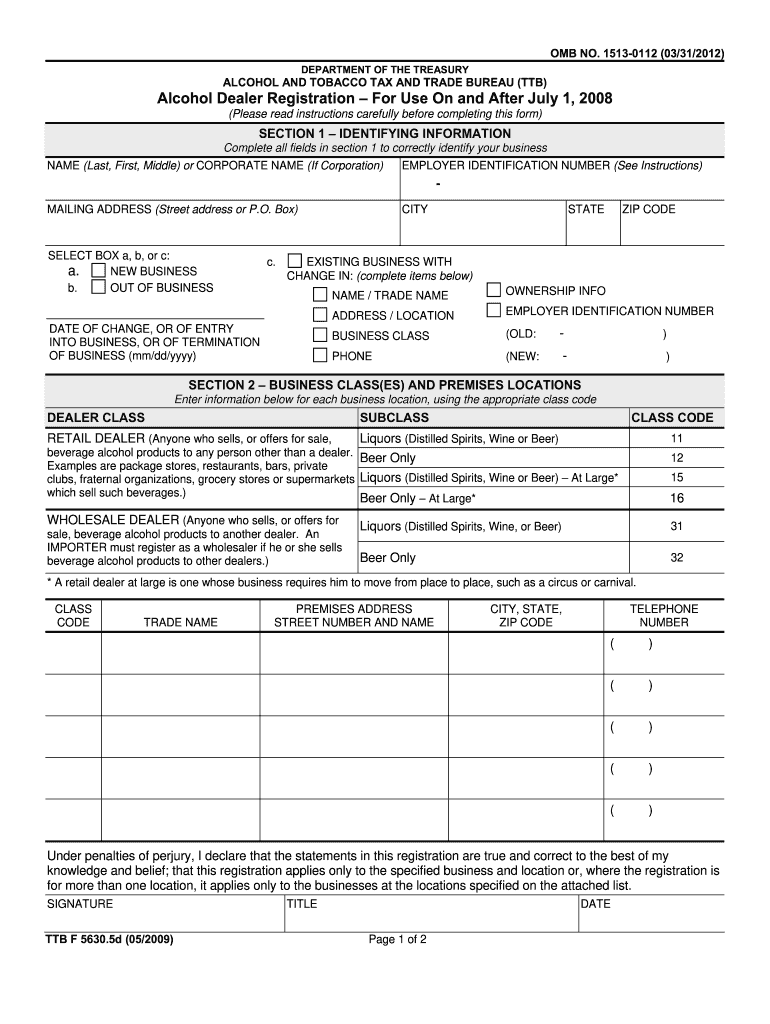

OMB NO. 1513-0112 03/31/2012 DEPARTMENT OF THE TREASURY ALCOHOL AND TOBACCO TAX AND TRADE BUREAU TTB Alcohol Dealer Registration For Use On and After July 1 2008 Please read instructions carefully before completing this form SECTION 1 IDENTIFYING INFORMATION Complete all fields in section 1 to correctly identify your business NAME Last First Middle or CORPORATE NAME If Corporation EMPLOYER IDENTIFICATION NUMBER See Instructions MAILING ADDRESS ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign alcohol dealer registration form

Edit your alcohol dealer registration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ttb form 5630 5d form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ttb alcohol dealer registration online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ttb f 5630 5d form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sales tax permit requirements form

How to fill out an alcohol dealer registration form:

01

Review the instructions: Carefully read the instructions provided with the form to understand the requirements and specific details needed to complete it accurately.

02

Gather necessary information: Collect all the required information, such as personal and business details, such as name, address, contact information, business entity type, and tax identification number.

03

Provide licensing information: If applicable, include any relevant licenses or permits related to alcohol sales, distribution, or manufacturing.

04

Fill in business details: Complete all sections related to the business, including the trade name, business address, and any additional locations where alcohol sales will take place.

05

Include ownership information: Provide details of the individuals or entities that own and operate the business, including their names, addresses, ownership percentages, and any relevant financial disclosures.

06

Complete financial information: Depending on the form, you may need to disclose financial information, such as revenue, prior business experience, and any financial documents requested.

07

Sign and date the form: Once all the necessary sections are completed, sign and date the form as the responsible party.

08

Submit the form: Follow the provided instructions to submit the form to the appropriate authority, such as a local liquor control board or state alcohol commission.

Who needs an alcohol dealer registration form?

01

Individuals or entities intending to engage in the sale, distribution, or manufacturing of alcohol products typically need to complete an alcohol dealer registration form.

02

This form is often required by regulatory bodies, such as state alcohol control boards or local licensing authorities, to grant permission to conduct alcohol-related activities legally.

03

It is important to check with the specific jurisdiction where the alcohol business will operate to determine whether an alcohol dealer registration form is required and the appropriate authority to submit it to.

Fill

sale request form

: Try Risk Free

People Also Ask about form 41

What is the purpose of the TTB?

Our Mission. Our mission is to collect the taxes on alcohol, tobacco, firearms, and ammunition, protect the consumer by ensuring the integrity of alcohol products, ensure only qualified businesses enter the alcohol and tobacco industries, and prevent unfair and unlawful market activity for alcohol and tobacco products.

What is a booze dealer?

Retail liquor dealer means any licensee who sells alcoholic or malt liquors under authority granted by this chapter to the holder of a retail liquor license.

What are the liquor laws in New Jersey?

With the exception of Newark and Jersey City, the law forbids hard liquor packaged goods sales before 9 am and after 10 pm any day of the week. This can be restricted further by local ordinance. Liquor stores may sell beer and wine during any hours that on-premises sales are allowed.

Who created the TTB?

TTB was formed in 2003 by the Homeland Security Act of 2002, which divided the functions of the Bureau of Alcohol, Tobacco and Firearms into two new entities.

What is a TTB form?

Application for Permit to Manufacture Tobacco Products or Processed Tobacco or to Operate an Export Warehouse. TTB F 5200.7. Schedule of Tobacco Products, Cigarette Papers or Tubes Withdrawn from the Market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 104 form from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including retail alcohol beverage licenses need not be displayed on the licensed premise, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send form 562 to be eSigned by others?

When you're ready to share your how to get a form 2, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete ttb registration form online?

Easy online alcohol dealer registration form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

What is alcohol dealer registration form?

The alcohol dealer registration form is a document that businesses must submit to state or federal authorities to legally sell, distribute, or produce alcoholic beverages.

Who is required to file alcohol dealer registration form?

Any individual or business entity that intends to manufacture, import, export, or sell alcohol must file an alcohol dealer registration form.

How to fill out alcohol dealer registration form?

To fill out the alcohol dealer registration form, you will need to provide information such as business details, the type of alcohol you intend to deal in, and any required identification information. Ensure all sections are completed accurately.

What is the purpose of alcohol dealer registration form?

The purpose of the alcohol dealer registration form is to ensure compliance with alcohol regulations, allowing authorities to monitor and regulate the distribution and sale of alcoholic beverages.

What information must be reported on alcohol dealer registration form?

Information that must be reported includes the dealer's name, business address, type of alcohol dealings, relevant licenses, and ownership details.

Fill out your alcohol dealer registration form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Alcohol Dealer Registration Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.